Setting up a Solana Validator

Starting from scratch

What is it?

A Solana validator is a participating node of the network. Baically, it keeps track of the state of the blockchain, while participating in the consensus process by voting on new blocks.

Many people get confused between a validator and an RPC node. And both are pretty similar. The RPC node is a node that serves data to the users, thus has to also keep track of the state of the network, but it doesn't participate in the consensus process, meaning, it doesn't vote on new blocks.

However, in order to serve the most up-to-date data, it has to keep track of the state of the network, and so, also execute the transactions. But just locally, without broadcasting it to the network, thus not participating in the consensus process.

Going back to the validators, they also put up a quite fair economic presence in the ecosystem. Which is also why so many people want to run one.

For newcomers to this post, I will keep it simple. Validators are the voice of the network, they are given a speaker and trusted to speak on favor of the network wellbeing. For that matter, indivdidual users of the network, can delegate their tokens to such validators, in order to make their voice be heard louder. The higher the tokens delegated by users (also known as stake), the validator has, the louder it will speak (the more blocks it will produce).

Translating this metaphor to real-world sceanrio, validators speak in the network by producing blocks, thus, "the more blocks they product, the more they speak for the network".

Of course, speaking for the network, as pretty as it could sound, is not done just for the sake of it, but also for the economic benefits. The more blocks a validator produces, the more rewards if would get from producing them.

It should be also said that running a validator is not for everyone as there are some technical and economic requirements that need to be met.

How much does it really cost to run a validator ?

Let's start with just the on-chain rewards and fees.

Validators can, natively, earn rewards by voting on produced blocks and by producing the right blocks.

But validators are not always capable of producing blocks due to a system design decission in solana called Leader Schedule, that is one of the keys of Solana's high TPS.

Time in solana is measured different as one might think. The comparison of day, would be epochs in solana, lasting around 2 days give or take. But these epochs are not the smallest time unit in solana, as epochs are divided into slots, each slot is approximately 400ms and it is a well divided into an smaller units called ticks, approximately 100ms.

Each slot of the epoch, has a validator assigned to it, that will be the one calling the shots (producing blocks) for that slot. As block time in solana is ~400ms, we could say that a validator in average can produce a block every ~400ms, without taking into account slots where no block is produced due to several other reasons, like the validator being offline or it not being up-to-date with the current state of the network.

When this happens, the validator is marked as delinquent and that affects its reputation in the network, and its future slot assignment in the future.

Bear in mind, slots assigned === opportunities to produce a block === rewards when the block is included in the chain. So, not being delinquent is actually a big deal.

But producing this block is not as costly as it is voting for other blocks. As we mentioned before a block can be produced every slot, and there are a lot of slots (around 432,000) in an epoch And the validator has to vote on those blocks, signing and sending a transaction, which pays fees.

These fees accrue for around 1.1 SOL daily, which montly is around 30 SOL, that, at current prices ($140), is around $4,200, and not available for everyone.

Moving onto more tangible matters, the validator in essence is nothing more than a server (a very performant one). This server has to have top-notch performance to not miss any slot an be tagged as delinquent.

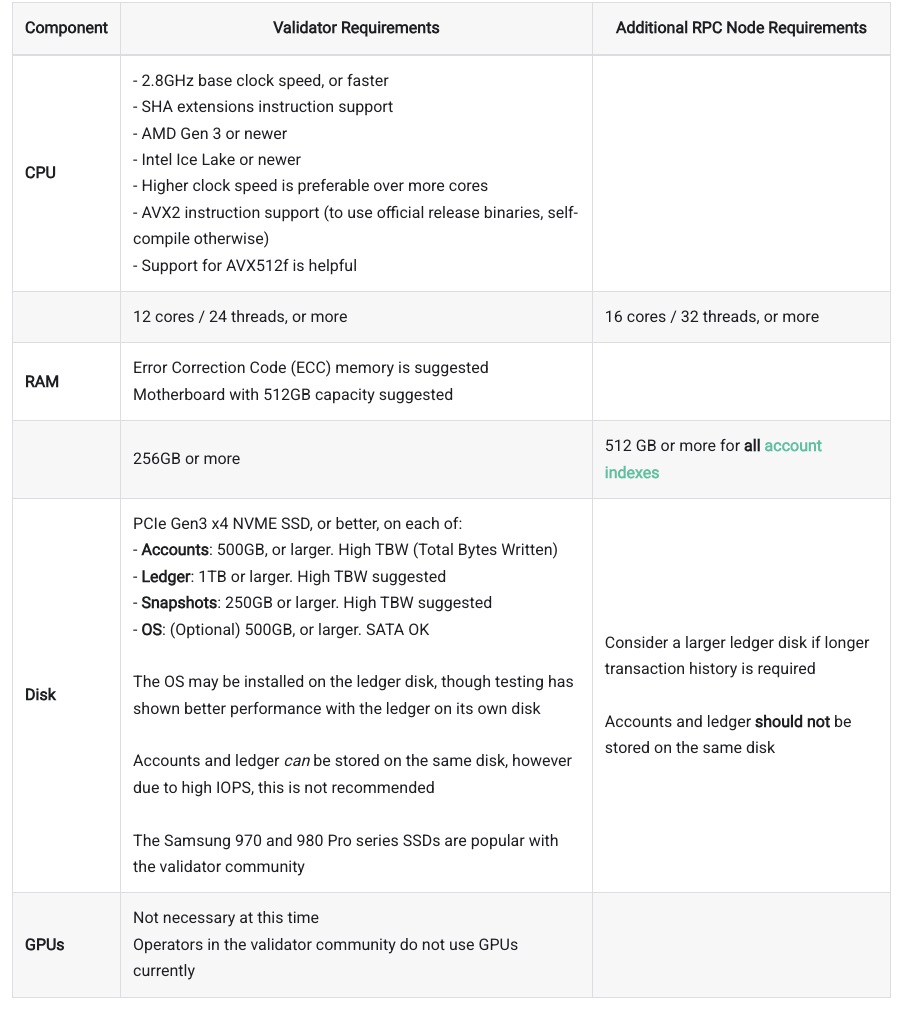

Based on Solana's (Anza) official requirements. A validator needs to have at least the following hardware:

However, this is just the beggining, the least one needs to spin it up. Although let's see how much that hardware would cost nowdays.

- CPU: For the requirements, we could be talking about an Intel Core i9 or a Ryzen 9. At current prices, around $300-$400, being a AMD Ryzen 9 7950X the most suited option.

- RAM: For the requirements, and given we would need at least 256GB, the prices are around $300-400 as well

- SSD: Next, we have the SSD. For this, we could be talking about a 1TB or 2TB of PCIe Gen3 x4 NVME SSD, which would cost around $100-150 each, so $400-$500.

- Electricity: Around $200 per month (REVIEW)

So taking into account the hardware, we would be talking about an inital investment of $7k, and a fixed cost of $6.2K per month just for the most basic requirements needed, that will likely not be enough to run a competent validator.

Of course, there are other platforms like latitude.sh that offer a more hands-off approach, where they take care of the hardware and the software, and you just have to figure the stake.

Websites like Cogent Crypto have calculators to help you estimate the costs of running a validator.

How do I earn rewards running a validator?

A validator's income consists basically of 3 types of rewards: Inflation rewards, Block rewards and MEV.

At the current date of writting this post, the total active stake of solana is 376.3M staked / 595.1M total.

In order to simplify this scenario let's suppose that we run a validator with 100% updatime and 0 dedlinquent slots with 0.1% of the stake (376k staked SOL). The formula to calculate a validator's probability of being selected as a leader to produce blocks is: (Validator's stake-weight / Total SOL staked in the network)

So, 376k staked sol (0.1%), would give the validator 0.1% of the total slots in an epoch to allow it to produce a block, so 432 slots.

As we said before, a validator can earn 3 types of rewards: Inflation rewards, Block rewards and MEV.

Inflation rewards are distributed at the end of each epoch based on the total inflation rate of the network (around 5% at the time of the writting), the stake percentage of the validator, the comission rate the validator decides to charge (can be set to 0%) and its participation on the consensus process (voting on blocks). Solana inflation is designed to be reduced over time, starting at ~8% with a disinflation rate of ~15% until a stable inflation rate of 1-2% is finally reached more here.

Users are encouraged to stake their SOL in the validator's stake pool, so they can have a cut of these inflation rewards.

When producing a block, the validator earns block rewards, that come from the fees included in the transaction. These fees can be priority fees or base fees. See solana transaction fees.

Base fees are, as the name implies, the base fee a transaction has to pay to be included in a block, it has a constant of 0.000005 SOL (5,000 lamports) per signature included in the transaction.

Priority fees on the other side, are an upside the transaction can pay to the validator to increase their probability of being included in a block.This fees are not constant and are calculated based on the work to be done by the validator based on the transaction and the current price of the network. The more work (transactions) are being done in the network, the higher this fees should be to ensure inclussion.

Before SIMD-0096, half of these fees were burnt and half of them were given to the validator.

Finally, MEV or Maximal Extractable Value is the ability of a valiadtor to include, exclude and reorder, arbitraily, the transactions of the block it produces in order to maximize its rewards. As validator leaders have control over the blocks packing and scheduling, they are able to perform the tasks afore metioned.

Mostly, validators in the solana network run either unmodified forks of the Solana client or the Jito client Jito's website.

Validators running the Jito Client, process transactions in the solana network via gossip and received transactions via a Jito relayer. The later skips the gossip process and directly sends the transactions to the validator.

Users can send transactions including a Jito tips on top of their priority fees. Transactions including the tip would be captured by searchers and sent to Jito relayer for then being share to the whole Jito Validator Network. These transactions would be included, excluded or reorganized by the Jito Block Engine via an off-chain auction mechanism (based on Jito tips, transaction fees, etc). It is to say that the block engine is the one in charge of optimizing value extraction so both tansactions from the solana gossip network and transactions from the Jito Relayer are taken into account.

After the auction is completed, the block engine would construct a block with the winning transactions and propose the block to the network.

Jito's block engine is designe to maximize validator returns selecting the most profitable transactions regardless of the source.

How to get started?

- Set up the server on latitude.sh or any other provider or build your own based on the specs needed.

- Run the jito client or the Agave (solana) client

- Join a stake pool or create your own

- Get stake from users willing to delegate to your validator

- Profit

How to get stake?

- Be active on social media and build an appealing validator for stakers

- Apply for the Solana Foundation Delegation program

Solana Foundation Delegation program

Becoming a validator in the Solana network, despite being permissionaless, comes at an economic cost. For this reason, the Solana Foundation has a delegation program to help new validators get started.

This program aims to increase the decentralization fo the network by allow validators to be self-sufficient over time, attacting external staking while maintainig high performance standards. Addtionally, it priotizes validatrors not running on popular setups like latitude or AWS.

Under this program, the foundation will cover the voting costs of the validators for the first year, starting at 100% during the rirst three months, then 75%, then 50% and 25% in the following quarters until the year is reached.

Additionally, the foundation will match 1:1 external stake ratio up to 100k SOL. Additionally, up to 40k from the remaining Foundation's stake would be allocated initially to help block production.